The mismatch stems from the way COLAs are calculated. Currently, the SSA bases annual increases on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure designed around the spending habits of younger, urban workers.

An alternative measure, the Consumer Price Index for the Elderly (CPI-E) weights housing, health care and utilities more heavily and would have produced a 3.1% increase in 2026 instead of 2.8%, according to Investopedia.

COLAs based on the CPI-W have lagged behind the CPI-E in each of the past three years — and in 18 of the past 26 years, by an average of 0.2% annually. This has meant that retirees’ annual raises haven’t always kept pace with the inflation of their most common expenses.

Even with a switch to the CPI-E formula, rising Medicare costs could offset some gains, Newsweek reported. Medicare Part B premiums, which are set to rise from the current level of $185 to $202.90 in 2026, continue to eat into COLA gains and outpace benefit increases.

Social Security benefits have increasingly lagged behind inflation. While 60% of cost-of-living adjustments outpaced inflation in the 1990s and 2000s, that fell to 40% in the 2010s and only 20% in the early 2020s — except for the 8.7% increase in 2023 driven by pandemic-era inflation.

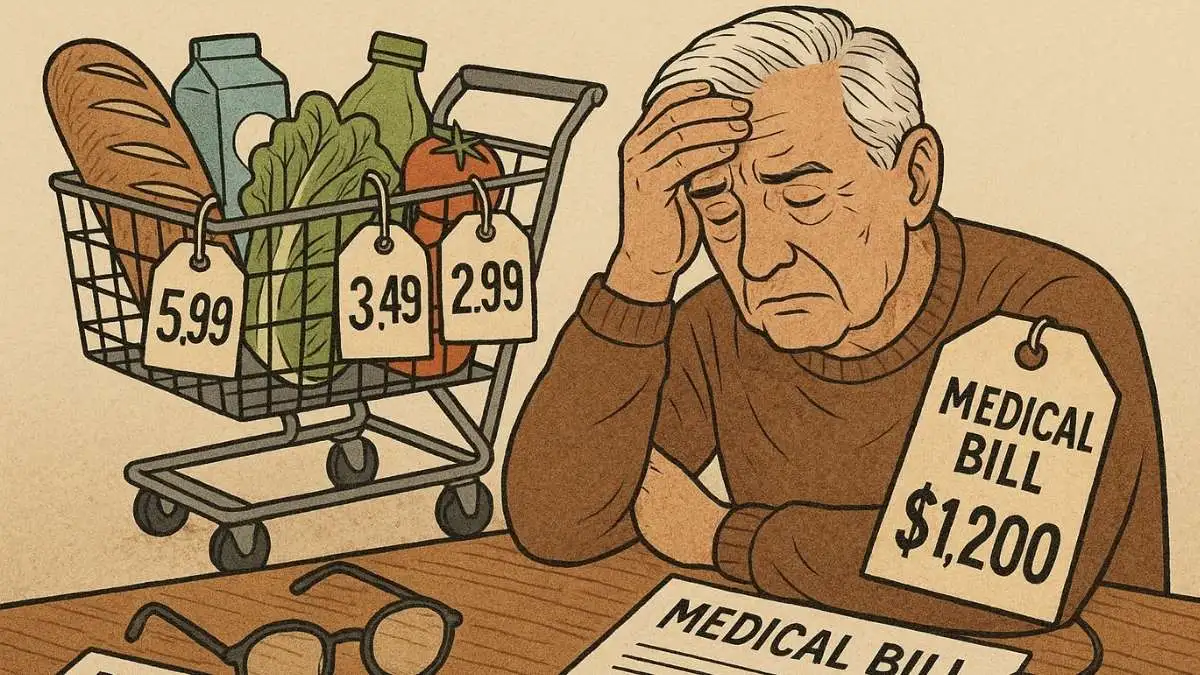

The Senior Citizens League (TSCL) reports that retirees who started benefits in 1999 have lost nearly $5,000 in lifetime payments compared with what they would have received under CPI-E. For those retiring in 2024, the shortfall could exceed $12,000 over a 25-year retirement.

TSCL also estimates that Social Security benefits have lost roughly 20% of their value since 2010. To fully restore their purchasing power, retirees would need an additional $370 per month, or $4,440 annually.

Congress has introduced two bills aimed at addressing the gap as any change to how the COLA is calculated would require a change in federal law.

The Boosting Benefits and COLAs for Seniors Act would overhaul how annual adjustments are calculated, while the Social Security Emergency Inflation Relief Act would temporarily add $200 per month to benefits until July 2026.

According to Newsweek, both proposals are backed by Democratic Sens. Elizabeth Warren, Kirsten Gillibrand, Ron Wyden and Chuck Schumer, among others.